Where does the tax reform for company bicycles stand?

The long-demanded legal equalization of e-bikes and electronic cars as company vehicles had been hinted at in spring. Now that there has been a government re-shuffle the tax reform seems to have been pushed way back again. The timing is quite unfortunate as the sale of e-bikes has reached a record high in Austria. The cycling coordinator for the city of Vienna, Martin Blum, is therefore among those demanding to take the “company bicycle” out of the tax reform. Instead a new legal framework should be passed by parliament as a separate motion as soon as possible.

“One of the few, if not the only ecological provisions (in the tax reform) would warrant a separate implementation,” Blum tweeted in early June when it became clear that the planned tax reform would be put on hold after the government had to resign. This would have included changes to the income tax law and the turnover tax law to allow “company bicycle models also in Austria in future,” explained Blum. “The company bicycle model is already on the table and it would be important to implement it immediately”, Blum added. He is also managing director of CycleCompetence member Mobility agency Vienna.

Company bicycles keep employees healthier

In general a company bicycle model means that employees provided with a bicycle by their employers which they can also use privately. Sometimes the users do carry a share of the costs. The rest or all of the price is deducted monthly from the gross income (e.g. in Germany).

For employers a company bicycle scheme means “healthier employees, holding them in the company, climate protection and fewer parking spaces that have to be built and maintained,” noted Blum. However, in Austria bicycles and e-bikes (as defined under tax law) cannot fully be deducted as input tax or from the gross wage – other than electronic cars. Additionally, the current regulations are unclear. “This unequal treatment was to be amended as pressured by some regional traffic authorities,” said Blum.

CycleCompetence member Radlobby Österreich supports this view: “Clarifying the legal situation and equalizing the treatment of company bicycles is a small measure with great effect in the fight against a lack of exercise among citizens and climate protection which is much neglected in the traffic sector,” stressed Radlobby spokesman Roland Romano. By amending the legal framework “companies would be motivated to support their employees in commuting to work emission-free.” He demanded “the parliament to tackle the issue before the next elections” in September. Romano called on the MPs to “pass the existing draft amendments”.

Non-monetary remuneration and input tax deductability

Ass reported here last year, an expert opinion commissioned by the CylceCompetence member the province of Vorarlberg shows that e-bikes do already have one tax advantage over a company car in one respect: When it comes to private use. Both e-bikes as well as regular bicycles can be used privately even if issued by the employer without having to be reported as non-monetary remuneration (“Sachbezug”). This is not the case for company cars.

However, this is currently only an expert opinion. The tax reform would have created a strong legal basis for this reasoning.

It would also have ended the inequality in the way an e-bike is treated under tax law when it comes to the purchase. Currently employers can only apply input tax deductability (“Vorsteuerabzug”) to regular bicycles or electronic cars they buy for their employees – but not for e-bikes. The latter are identified as “powered bikes” (Kraftrad) under the tax law but as “bicycles” under the road code.

Record in bicycle purchase with e-bike boom

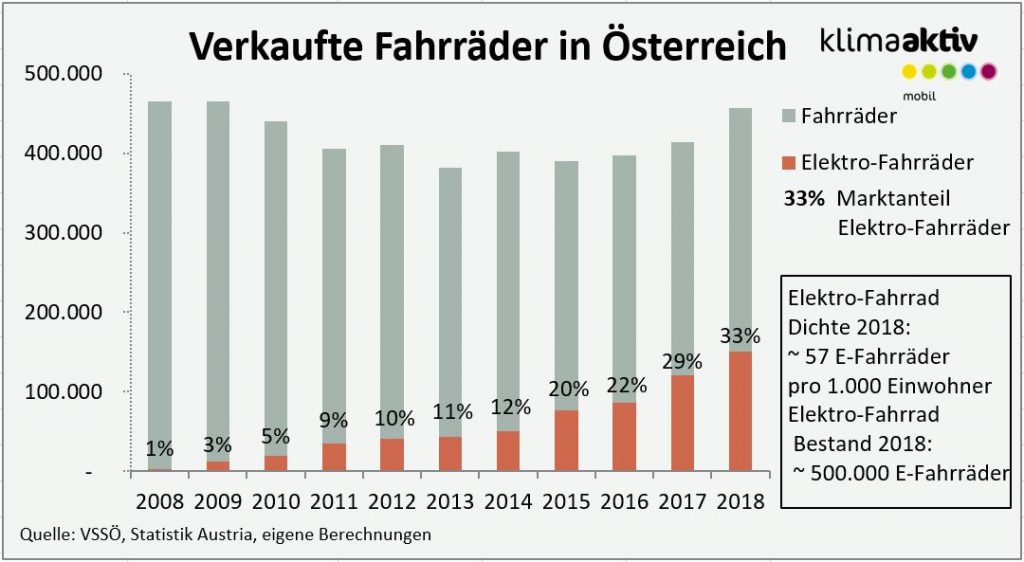

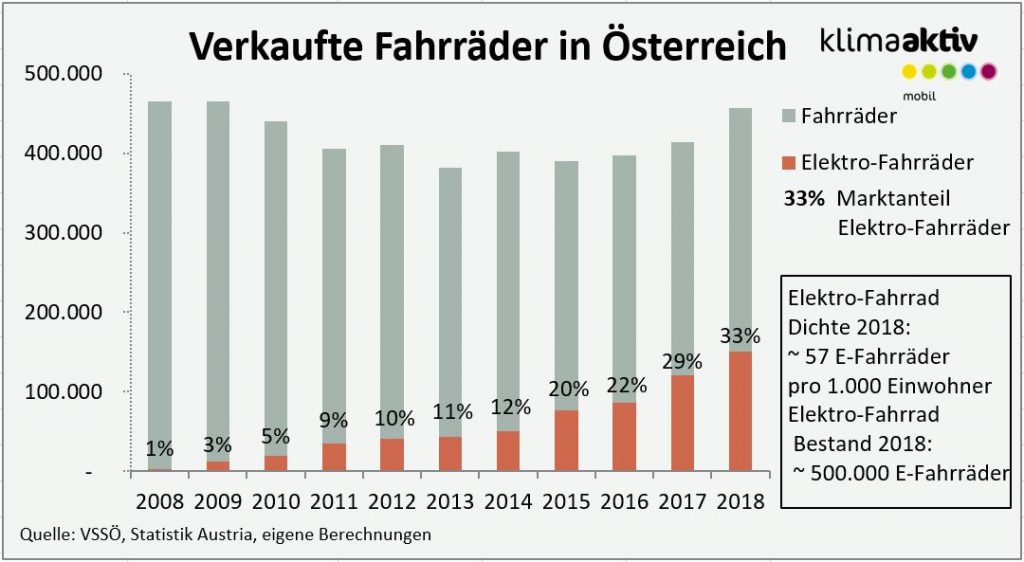

Never was the share the bicycle industry had in the overall turnover of sporting goods in Austria as high as in 2018. The reason for this is the major increase in e-bikes. Last year the whole bicycle market comprised a volume of around 457.000 bicycles – the highest figure since 2009. The share of e-bikes of that total stood at 33%. Only in Belgium (45%) and the Netherlands (40%) this share is higher. (sources: OTS). This trend would be increased in Austria by equalizing tax treatment of e-bikes and electronic cars.

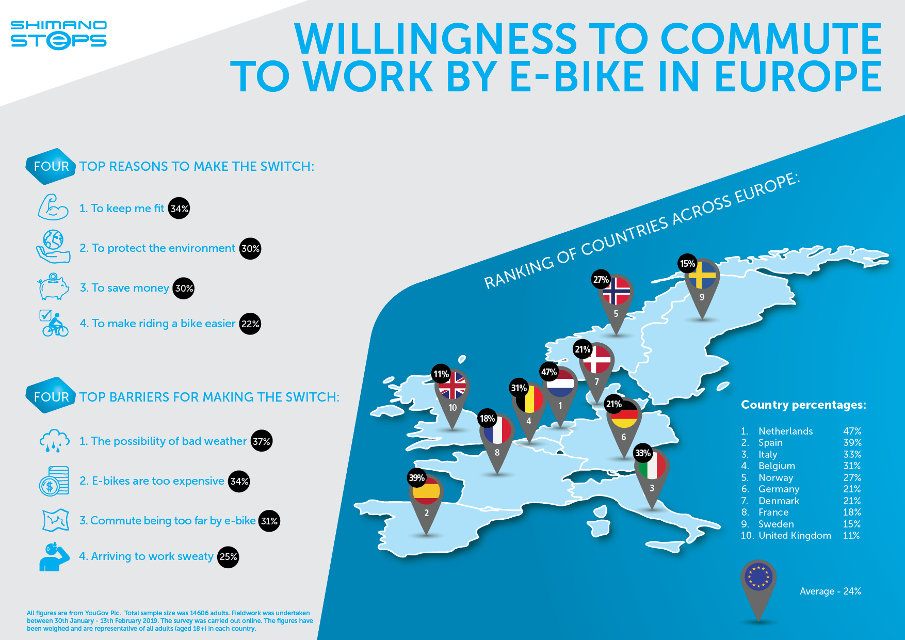

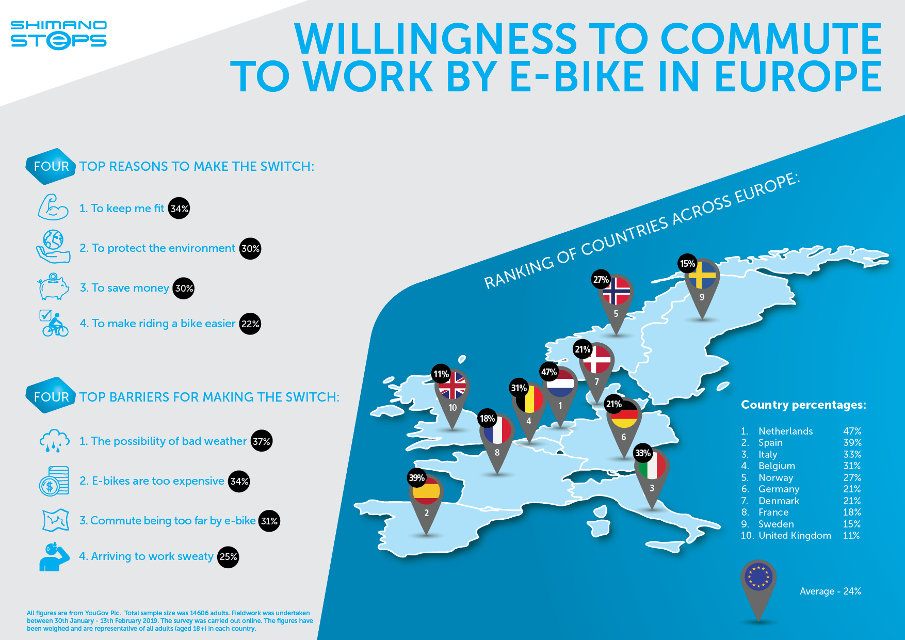

How much this would help the environment is shown in a study by Shimano: In ten European countries it was noted that an e-bike is a strong incentive for people to switch from cars for their daily commute. This willingness was highest in the Netherlands (47%) followed by Spain (39%) and Italy (33%). No Austrians were surveyed.

Successful model Germany

In Germany one way to access a company bicycle is for a company to make a tax-exempt purchase of bicycles either directly or via a “Job-Rad” provider (z.B. Jobrad.org). The legal framework is clearly defined including caps on the tax exemption.

For Austria Martin Blum notes: “Eliminating the VAT and the income tax alone would make bicycles up to 50% cheaper for employees than if they bought them themselves. This is highly relevant and could be an incentive for many to start cycling and in turn contribute to environmental protection.”

CycleCompetence member klimaaktiv mobil is providing information on company bicycles here.

Photos: Peter Provaznik for Bosch eBike Systems

Cycling Competence Members in this article:

More articles with this member:

Share this article:

Where does the tax reform for company bicycles stand?

Share this article:

The long-demanded legal equalization of e-bikes and electronic cars as company vehicles had been hinted at in spring. Now that there has been a government re-shuffle the tax reform seems to have been pushed way back again. The timing is quite unfortunate as the sale of e-bikes has reached a record high in Austria. The cycling coordinator for the city of Vienna, Martin Blum, is therefore among those demanding to take the “company bicycle” out of the tax reform. Instead a new legal framework should be passed by parliament as a separate motion as soon as possible.

“One of the few, if not the only ecological provisions (in the tax reform) would warrant a separate implementation,” Blum tweeted in early June when it became clear that the planned tax reform would be put on hold after the government had to resign. This would have included changes to the income tax law and the turnover tax law to allow “company bicycle models also in Austria in future,” explained Blum. “The company bicycle model is already on the table and it would be important to implement it immediately”, Blum added. He is also managing director of CycleCompetence member Mobility agency Vienna.

Company bicycles keep employees healthier

In general a company bicycle model means that employees provided with a bicycle by their employers which they can also use privately. Sometimes the users do carry a share of the costs. The rest or all of the price is deducted monthly from the gross income (e.g. in Germany).

For employers a company bicycle scheme means “healthier employees, holding them in the company, climate protection and fewer parking spaces that have to be built and maintained,” noted Blum. However, in Austria bicycles and e-bikes (as defined under tax law) cannot fully be deducted as input tax or from the gross wage – other than electronic cars. Additionally, the current regulations are unclear. “This unequal treatment was to be amended as pressured by some regional traffic authorities,” said Blum.

CycleCompetence member Radlobby Österreich supports this view: “Clarifying the legal situation and equalizing the treatment of company bicycles is a small measure with great effect in the fight against a lack of exercise among citizens and climate protection which is much neglected in the traffic sector,” stressed Radlobby spokesman Roland Romano. By amending the legal framework “companies would be motivated to support their employees in commuting to work emission-free.” He demanded “the parliament to tackle the issue before the next elections” in September. Romano called on the MPs to “pass the existing draft amendments”.

Non-monetary remuneration and input tax deductability

Ass reported here last year, an expert opinion commissioned by the CylceCompetence member the province of Vorarlberg shows that e-bikes do already have one tax advantage over a company car in one respect: When it comes to private use. Both e-bikes as well as regular bicycles can be used privately even if issued by the employer without having to be reported as non-monetary remuneration (“Sachbezug”). This is not the case for company cars.

However, this is currently only an expert opinion. The tax reform would have created a strong legal basis for this reasoning.

It would also have ended the inequality in the way an e-bike is treated under tax law when it comes to the purchase. Currently employers can only apply input tax deductability (“Vorsteuerabzug”) to regular bicycles or electronic cars they buy for their employees – but not for e-bikes. The latter are identified as “powered bikes” (Kraftrad) under the tax law but as “bicycles” under the road code.

Record in bicycle purchase with e-bike boom

Never was the share the bicycle industry had in the overall turnover of sporting goods in Austria as high as in 2018. The reason for this is the major increase in e-bikes. Last year the whole bicycle market comprised a volume of around 457.000 bicycles – the highest figure since 2009. The share of e-bikes of that total stood at 33%. Only in Belgium (45%) and the Netherlands (40%) this share is higher. (sources: OTS). This trend would be increased in Austria by equalizing tax treatment of e-bikes and electronic cars.

How much this would help the environment is shown in a study by Shimano: In ten European countries it was noted that an e-bike is a strong incentive for people to switch from cars for their daily commute. This willingness was highest in the Netherlands (47%) followed by Spain (39%) and Italy (33%). No Austrians were surveyed.

Successful model Germany

In Germany one way to access a company bicycle is for a company to make a tax-exempt purchase of bicycles either directly or via a “Job-Rad” provider (z.B. Jobrad.org). The legal framework is clearly defined including caps on the tax exemption.

For Austria Martin Blum notes: “Eliminating the VAT and the income tax alone would make bicycles up to 50% cheaper for employees than if they bought them themselves. This is highly relevant and could be an incentive for many to start cycling and in turn contribute to environmental protection.”

CycleCompetence member klimaaktiv mobil is providing information on company bicycles here.

Photos: Peter Provaznik for Bosch eBike Systems